MAT Submission Instructions

HOW TO ACCESS THE REMITTANCE FORM

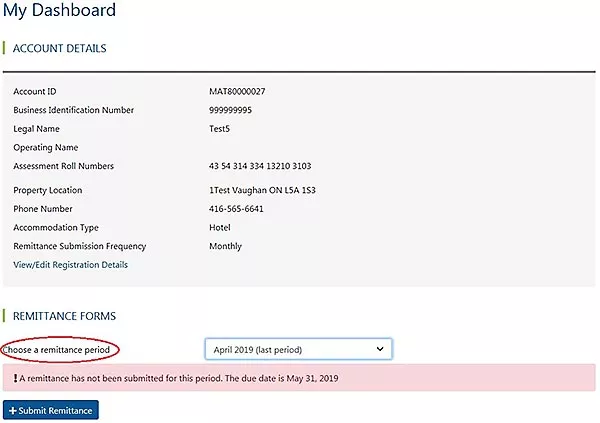

1. Go to the Municipal Accommodation Tax System.

2. Log in using your MAT ID assigned and password setup during the registration process.

3. Select the remittance period in the “Remittance Forms” section and click on the “Submit Remittance” button.

HOW TO COMPLETE THE REMITTANCE FORM

Information for hotels

Any personal information on this form is collected under the authority of By-law 029-2019 (PDF), By-law 152-2019 (PDF), By-law 158-2019 (PDF) and By-law 183-2019 (PDF) posted on the City of Vaughan’s By-law Library webpage. These by-laws establish the authority for the City to impose Municipal Accommodation Tax (MAT) on the purchase of stays at hotel and short-term rental housing in Vaughan, whereas short-term rental housing is considered a stay of 29 days or less. The personal information will be used for the administration and enforcement of the MAT collection.

- remittance period:

- Select the remittance period

- If remittance is submitted before the due date, changes are allowed until the due date

- Remittance period will remain open until submission is received even after the due date. Once overdue remittance is submitted, no changes are allowed.

- box “A”: Enter number of rooms available

- box “B”: Enter number of room nights sold in the reporting period

- box “C”: Enter the average daily rate for the room nights sold

- box “D”: Enter the amount of revenue received in the reporting period. If no tax was collected in the reporting period enter ‘0’

- box “E”: Enter the amount of exemptions in the reporting period. List of exemptions can be found in By-law 029-2019 (PDF)

- box “F”: Enter the amount of adjustments to the revenue associated to before or/and the reporting period. It can be positive or negative. If an amount is inputted, an explanation is required.

- box “G”: Calculation based on the amounts in box “D”, “E” and “F”

box “H”: Calculation based on four per cent of amount in box “G” (Room revenue subject to Municipal Accommodation Tax)

payment method:

- cheque

- Cheque is payable to the City of Vaughan. Indicate your MAT ID on the cheque.

- Attach a copy of the submission confirmation with the cheque

- Mail your cheque to

Attn: Property Tax office

City of Vaughan, Financial Services

2141 Major Mackenzie Dr

Vaughan ON L6A 1T1 - Place in marked drop-off boxes available at each entrance at City Hall, 2141 Major Mackenzie

- online payment through the bank or Electronic Fund Transfer (EFT) payment

- For more details, please contact us at mat@vaughan.ca or 905-832-2281

- not applicable

- Please choose this option if the value in box “H” is equal to or less than ‘0’

attach a file:

- cheque

Upload a file (CSV, Excel or PDF format) that provides additional details about each booking for the submission period.

The file must include these columns:

- booking reference - a code that uniquely identifies the booking

- booking date - date the booking was made

- stay start date - date the stay commenced

- room rate - rate charged for the room or accommodation per night

- number of nights - number of nights stay booked

- total room charge - total amount charged for the room or accommodation for all night

- exempt - yes/no

explanation - if exempt is yes, provide additional information to support exemption of booking

Submission timeline for hotels

- If MAT is paid monthly, a Municipal Accommodation Tax Return form must be completed and received by the City by the last day of every month for the previous month's reporting period even if no tax was collected. For example: April's monthly tax return (April 1 to April 30) must be received by May 31.

- If MAT is paid quarterly, a Municipal Accommodation Tax Return form must be remitted by April 30, July 31, Oct. 31 and Jan. 31 (of the following year) with the MAT collected for the previous three months. .

- Late payment charges will be charged on outstanding balances as outlined in the By-law 029-2019 (PDF).

The following section pertains to short term rental (STR) operators and brokers

License status has an impact on the remittance period that can be selected

| Licence Status | Remittance period |

|---|---|

| Approved | Remitting period starting from license issued onward |

| Expired | Remitting period starting from license issued to expired |

| Revoked | Remitting period starting from license issued to revoked |

| Denial | No remittance allowed |

| Appealed | Remitting period starting from license issued to appealed |

Any personal information on this form is collected under the authority of By-law 029-2019 (PDF), By-law 152-2019 (PDF), By-law 158-2019 (PDF) and By-law 183-2019 (PDF) posted on the City of Vaughan’s By-law Library webpage. These by-laws establish the authority for the City to impose Municipal Accommodation Tax (MAT) on the purchase of stays at hotel and short-term rental housing in Vaughan, whereas short-term rental housing is considered a stay of 29 days or less. The personal information will be used for the administration and enforcement of the MAT collection.

- remittance period:

- Select the remittance period

- If remittance is submitted before the due date, changes are allowed until the due date

- Remittance period will remain open until submission is received even after the due date. Once overdue remittance is submitted, no changes are allowed.

- box “A”: Enter number of rooms available for rental

- box “B”: Enter number of room nights booked for all available rooms in the reporting period

- box “C”: Enter the average daily rate for the room nights sold

- box “D”: Enter the amount of revenue received in the reporting period. If no tax was collected in the reporting period enter ‘0’

- box “E”: Enter the amount of adjustments to the revenue associated to before or/and the reporting period. It can be positive or negative. If an amount is inputted, an explanation is required.

- box “F”: Calculation based on the amounts in box “D” and “E”

box “G”: Calculation based on four per cent of amount in box “F” (Room revenue subject to Municipal Accommodation Tax)

- payment method:

- cheque

- Cheque is payable to the City of Vaughan. Indicate your MAT ID on the cheque

- Attach a copy of the submission confirmation with the cheque

- Mail your cheque to

Attn: Property Tax office

City of Vaughan, Financial Services

2141 Major Mackenzie Dr

Vaughan ON L6A 1T1 - Place in marked drop-off boxes available at each entrance at City Hall, 2141 Major Mackenzie Dr

- online payment through the bank or Electronic Fund Transfer (EFT) Payment

- For more details, please contact us at mat@vaughan.ca or 905-832-2281

- not applicable

- Please choose this option if the value in box “G” is equal to or less than ‘0’

- cheque

attach a file:

Upload a file (CSV, Excel or PDF format) that provides additional details about each booking for the submission period.

The file must include these columns:

- booking reference - a code that uniquely identifies the booking

- booking date - date the booking was made

- stay start date - date the stay commenced

- room rate - rate charged for the room or accommodation per night

- number of nights - number of nights stay booked

- total room charge - total amount charged for the room or accommodation for all night

- exempt - yes/no

- explanation - if exempt is yes, provide additional information to support exemption of booking

Submission timeline for short-term rental property

- A Municipal Accommodation Tax Return form must be remitted quarterly: by April 30, July 31, Oct. 31 and Jan. 31 (of the following year) for the MAT collected for the previous three months. The form must be completed and received by the city by the dates listed above, even if no tax was collected

- Late payment charges will be charged on outstanding balances as outlined in By-law 183-2019(PDF).

Contact us

Questions about Municipal Accommodation Tax?

You can email the City at mat@vaughan.ca.