Learn About the Budget

It takes a lot of planning to create a budget for a city the size of Vaughan. Learn more about how it works!

What makes up the budget?

A municipality’s budget is made up of two parts:

- Operating – spent on running City facilities, programs and services

- Capital – spent on projects that include building and repairing City infrastructure, such as roads and buildings

What funds the budget?

To fund the operating and capital budgets in Vaughan, annual revenues are generated. The main sources of revenue are property taxes, water and wastewater rates, stormwater charges, user fees and development charges.

- Property taxes - The property tax bill is divided between the City of Vaughan, York Region and the York Region English and French school boards for education. Vaughan uses its portion of the property tax to pay for City programs and services.

- User fees and service charges - These are paid by residents and businesses when accessing certain services, such as recreation programs and permits.

- Development charges - These are paid by developers and are used to help fund growth-related capital projects, such as roads, pipes, libraries and fire halls.

- Water and wastewater rates and stormwater charge - These are paid by residents and businesses for water related services to ensure the City can provide safe drinking water, collect wastewater effectively, manage stormwater to mitigate flooding and save for future infrastructure needs.

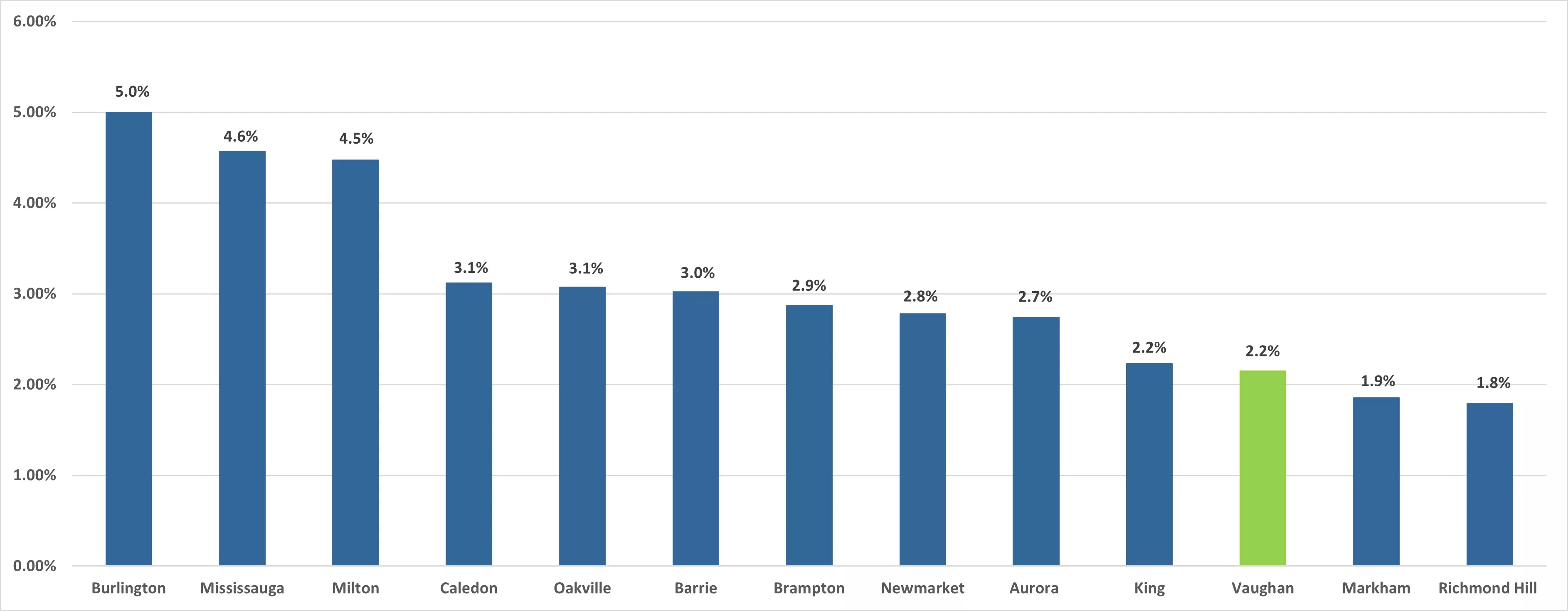

How do Vaughan’s taxes compare to other GTA municipalities?

The City of Vaughan has one of the lowest tax rates in the GTA. Vaughan is focused on keeping tax rates low and maintaining service levels. The following chart shows the average tax rate increase from 2020 to 2024.

Image